If nothing is done to fix the home insurance markets, people will move away from real estate areas with the greatest exposure to severe climate change, as the cost of owning homes in these markets will make them less desirable.

This chart, showing the changes in CO2 over time (measured in CO2 molecules per million air molecules) and the corresponding rise in temperature, is likely the most illustrative depiction of climate change.

Source: IPCC

The concentration of CO2 has reached its highest recorded levels, leading to an unprecedented rise in temperatures. It is an indisputable fact that the increasing CO2 levels, are the result from decades of burning fossil fuels, and are the largest contributor to global warming.

The Insurance Industry Is Keeping Score Of Climate Change

A sad truth with regard to climate change is that everybody will feel its impact, including the economic costs. For this reason, we can substitute the word Life from Bob Dylan's, "All Along The Watchtower", with Climate Change and the words ring ever true.

"There are many here among us who feel that climate change is but a joke. But you and I, we've been through that, and this is not our fate, so let us not talk falsely now, the hour is getting late." - Bob Dylan

This impact is evident in the rising costs of homeowner insurance. Home insurance premiums are priced out based on the risk of catastrophes, and as climate change leads to more frequent natural disasters, the insurance industry is experiencing greater losses.

This chart from AM Best, the rating agency for the insurance industry, show the net underwriting losses that the home insurers have experienced during recent years.

An Uncertain Environment For Property Insurance

The rapid acceleration of global warming and the profound effects of climate change have created an uncertain environment for the insurance industry, leading to unpredictable costs for homeowners.

While headlines such as "The Home Insurance Market is Crumbling," are becoming more frequent, the more significant story with greater consequences is the turmoil that this places on homeowners.

"But as climate change increases the frequency and severity of extreme weather, insurers — especially those in areas most impacted by floods and fires — are raising their premiums, or pulling out altogether, impacting the affordability and availability of home and fire insurance."

Over the last year, homeowner's insurance premiums have risen 21%, due to the increasing frequency of natural catastrophes. It's not just hurricanes or forest fires driving these hikes; while those events do capture much of the attention, tornadoes, windstorms, and hailstorms are causing homeowners in the middle of the country to face some of the steepest cost increases.

Additionally, residents in states that lack regulatory oversight of insurance prices are facing high insurance rates. According to the New York Times, "recent research points to a striking pattern: Higher premiums are being charged in states where regulators apply less scrutiny to requests for rate increases, compared with states where officials question the justifications offered by companies and try to keep rates low, the research shows."

Homeowner Insurances Pricing Trends

Over the last year, homeowner's insurance premiums have risen by 21% as natural catastrophes become more common. It's not just catastrophes in hurricane-prone areas that are causing this increase. While these events often gain the most attention, tornadoes and windstorms across the middle of the country are leading to some of the steepest cost increases for homeowners in these regions.

According to Money Magazine, as of 2023, the ten states with the most expensive home insurance policies are:

Florida: $10,996

Louisiana: $6,354

Oklahoma: $5,444

Texas: $4,456

Mississippi: $4,312

Colorado: $4,072

Nebraska: $3,962

Alabama: $3,939

Kansas: $3,437

Arkansas: $3,368

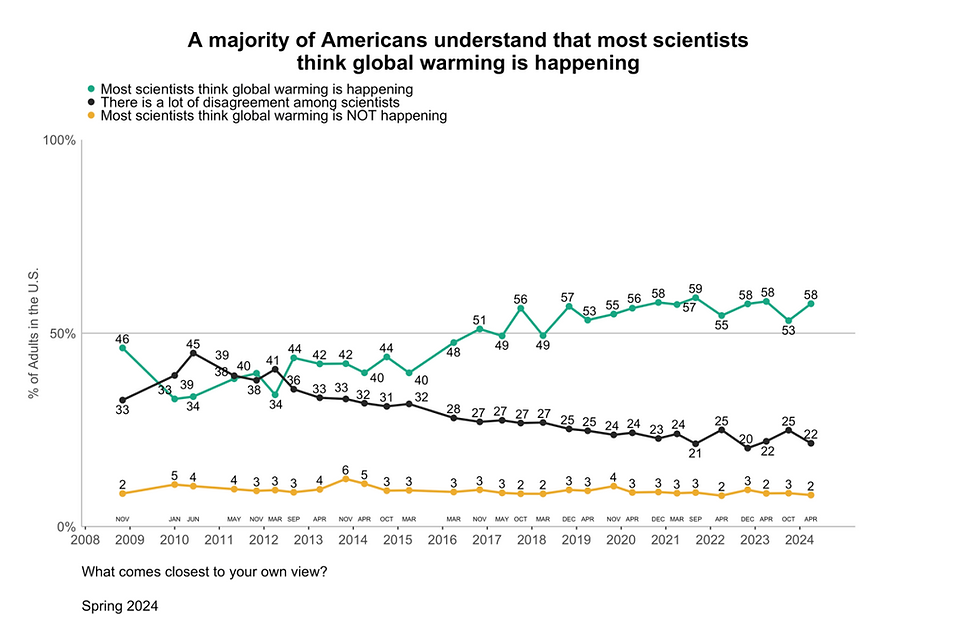

An Ever Dwindling & Tiny Segment Of Climate Deniers

Given the extensive data and scientific evidence showing that rising temperatures are adversely impacting the climate, it shouldn't take rising insurance costs to convince climate deniers that the world is changing. However, that may be what it takes because when things affect people's wallets, the reality hits home.

In fact, according to research from Yale, people being a climate change skeptic is becoming an increasingly rare stance.

Source: Yale

With record-warm temperatures (just google Hottest Year on Record), the frequency and severity of natural catastrophes will continue to increase, leading to even higher insurance premiums.

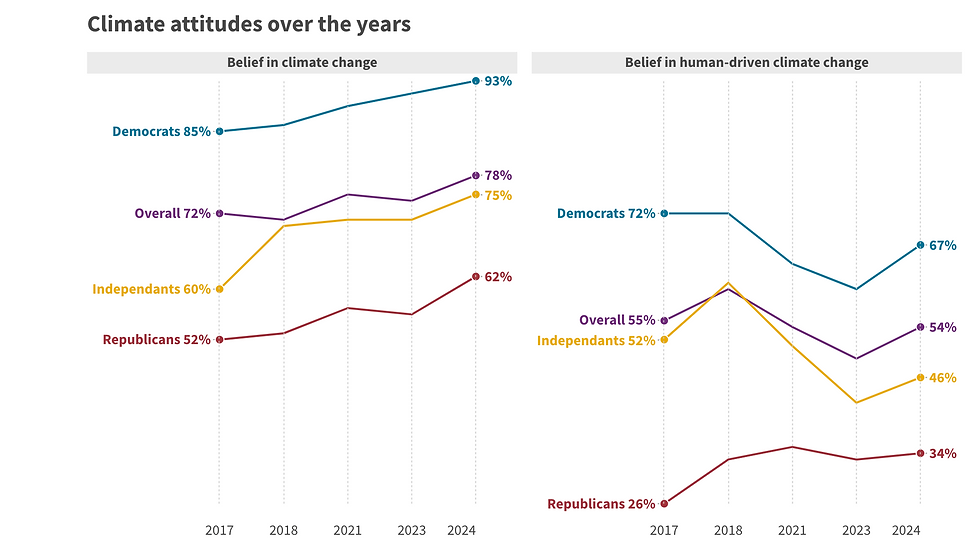

Eventually, the remaining climate deniers have to face the facts and the changes we are all contending with. This results in changed perceptions, and while acknowledgment of climate change remains a political issue, irrespective of political affiliation, research from The Energy Policy Institue at The University of Chicago indicates that people are increasingly acknowledging the climate change is happening.

Source: EPIC

Younger Generations Offer Hope For The Future

Data from the research organization, Pew, indicates that younger people have greater regard for climate change than older generations, and believe that climate change needs to be a top policy priority.

This is evidenced by younger generations preference to completely phase out fossil fuels.

Younger Generations Are Also The Most Impacted By Changing Insurance Markets

In addition to their greater concern for climate issues, younger generations are also the most impacted by the increased turmoil in home insurance markets. It’s not possible to obtain a mortgage without homeowners insurance, and the homebuying market is perpetually led by younger buyers, especially families seeking their first homes.

In just the past few weeks, here is example of this turmoil, via The Center For International Environmental Law.

On July 1, Progressive Insurance pulled renewals for around 100,000 homes on Florida’s coastline. On July 3, State Farm began to pull wildfire insurance for approximately 70,000 homeowners in California, a plan it announced in March. As insurers seek to limit their exposure to climate-induced weather events like hurricanes and wildfires, insurance premium increases and policy nonrenewals have become a summer norm in the United States (US), making housing more unaffordable in the process.

Homeowners Insurance Market In Disarray: Solutions Needed For A Growing Challenge

As climate change becomes a growing economic issue, creative solutions will be needed accross the private sector, along with government policy / involvment to tackle rising insurance costs.

This speech that Senator Whitehouse gave as part of a Senate Hearing on Insurance Upheaval from Climate Change captures the severity of the issues that homeowners face.

If nothing is done to fix the home insurance markets, people will move away from real estate areas with the greatest exposure to severe climate change, as the cost of owning homes in these markets will make them less desirable

Comments